|

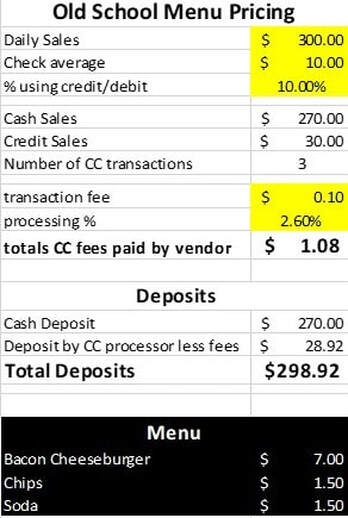

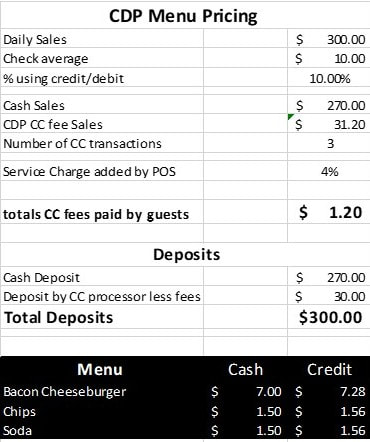

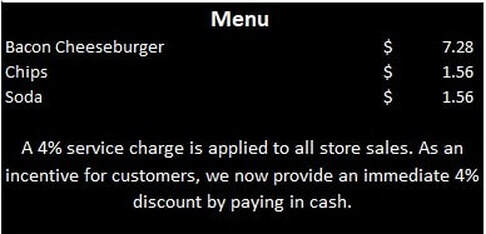

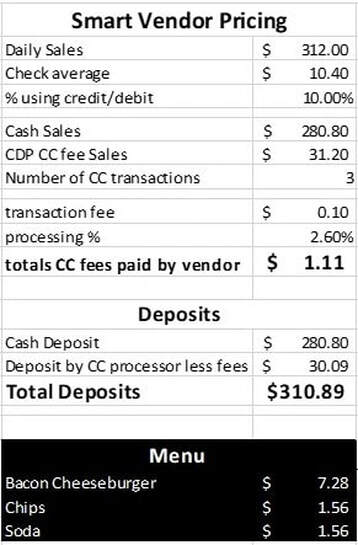

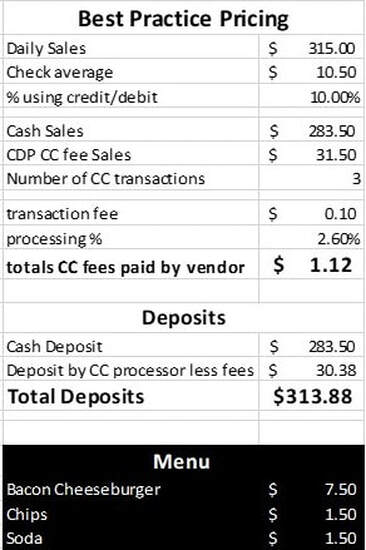

This is one of the three most often asked questions on Facebook groups with the least understanding of what is being asked. Most people really mean to ask, “what is the cheapest way to process credit cards?” A POS (point of sale) system is a computerized cash register. A POS often DOES NOT necessarily have integrated credit card processing. Credit card processing can be completely stand alone from the cash register. A POS can be an app like https://loyverse.com/us/pricing (FREE!) or Square (without using their card processing) or a physical machine like HarborTouch, Posi-Touch, NCR, Panasonic, etc., etc. All the average food vendor needs is basic inventory, net sales, taxes, discounts and sales mix capabilities in a POS. Processing credit cards can also be a part of a POS system or POS app. As can labor/payroll or distributor ordering add-ons or loyalty programs. The most important question – “What do I REALLY need at this stage of my business and how will it impact my profit.” Since over 80% of ALL payroll is direct deposit taking debit and credit is well past mandatory. A cash only vendor is or soon will be dying a slow death. The question is which credit card processor to use. I have already discussed credit cards at length here. This post will be showing the math and impact on your menu of the different payment strategies. Old School Approach  This old school price model shows a vendor using Square as credit card processor. Only 10% of his sales are in credit or debit processing. At the end of the day his bank account would have $298.92 in deposits since the Square would keep $1.08 in processing fees. Meaning the vendor is taking responsibility for processing fees. The guest credit card receipt will not have weasel words to explain an additional credit card fee. If two guests come up and order the same items, one pays cash and the other pays credit, they are charged the EXACT same price. No potential for service slowing complaints. This vendors menu is easy to read no confusing pricing and no easy to overlook disclaimers. Cash Discount Program (CDP)  A cash discount program is offered by several processing companies and utilizes rules allowed by all the credit card issuing institutions. At its basic form a vendor lists their menu pricing to include processing fees (usually 4% above cash price) and then offers a “discount” to guests opting to use cash. Then the credit card processor deposits money less the 4% processing fee. Effectively giving the vendor the same amount of money as if all his guests paid in cash. The menu becomes clumsy to read. Legally this program requires either TWO prices listed - one for cash and one for credit. Just like your local filling station. Or...  Your menu MUST include a disclaimer explaining the service charge and cash discount. Like this one. (Weasel words!) Any vendor with more than a day’s experience knows reading a menu is NOT a guest’s strong point. Let alone any language barrier. Now imagine those same two friends ordering the EXACT same food. One pays with cash and one pays with credit. Do you think for a second that the credit card purchaser will not complain? Even a half-hearted complaint will be heard by other guests and how you handle it will be remembered. No matter what the end result of the conversation may be, you have just increased your service times just to save a few pennies. Not exactly smart business. There will be guests that will happily pay the full amount credit listed on your menu. Think about that. If they happily pay the credit card amount, they are saying your food is worth the price! Then why would you discount someone choosing to pay in cash??? Does your food have less value for them? Smart Vendor Pricing If your guests don’t complain about a 4% service charge being already figured into your pricing, why not just drop the cash discount nonsense, raise your prices officially that extra 4% and you reap the profits rather than the scammer that convinced you use a CDP? In this example you can see the Average check increased $0.40 (4%) to reflect the menu price increase. Look at the deposits for the day. The smart vendor made an extra $10.89 with the exact same guest count. In other words, the vendor DID NOT give away hard earned money to have “free” credit card processing. The menu on the other hand contains pennies. If you are a tax included vendor this scares you. Let’s fix that. Best Practice Vending  A vendor that includes sales tax (or the state does not tax food sales) should price on the quarter. Making for less coin change needed. (Please don’t argue about change slows you down. It DOES NOT.) Be brave price on the quarter. The vendor now receives $13.88 MORE in deposits than if they fell for the “free” processing scams. Compared to the “old school” price model once they accounted for credit card processing in their menu prices, they made $14.96 MORE in deposits. The menu is easy to read with no service charge, cash discount nonsense disclaimer. Two friends ordering the exact same items pay the exact same total, no questions, comments, or complaints. Accounting for credit card processing in your menu prices is just like accounting for the bacon, cheese, meat, bun, condiments, wrapper, napkins, and a carryout bag for your Bacon Cheeseburger. It really is just that simple.

2 Comments

I see this question often on Facebook groups and usually don’t answer because I can’t really think of anything “I wish I had known”. My first vending operation was as a fundraiser operating off my restaurant’s food license. I provided food for shoppers attending a “Trash or Treasure” yard sale event held in a National Guard Armory. Our restaurant sold Coca Cola products and at the time Coke USA would loan small food trailers to restaurants as long as they bought post mix Coca Cola products to sell. They even provided cups! Coke dropped off the trailer Friday evening, gave brief training on the equipment and hook ups and told us they would be back Monday morning for pick up. Since the event ran only a few hours on Saturday that gave us way more time than needed for our event. We sold $1.00 hot dogs, $0.50 Coke and Chips. With every purchase we gave discounts and coupons for our restaurant as well as gave away logo t-shirts, coffee mugs and plastic cups. All profits went to the charity, our only goal was to promote our restaurant while raising some money for charity. At the end of the day we raised $425. Which does not sound like a lot but at $2.00 a combo that was a lot of guests we served. I remember running the P&L statement for the trailer and was surprised how much money we put on the bottom line to donate. I had the trailer pay for 2 employees, myself, ALL the Coke products plus all the food, coupon printing, flyers and give-a-ways. Still managed to write a check for the charity for $425. We got so much good press and community support from that one event the restaurant rode a wave of coupon redemption and positive comments for several weeks. What do I wish I had known? Nothing. What do I wish I had done differently? Started sooner. At that point I was 3 years into my career as a mediocre fast food manager. I had done a couple of good things and lots of ok things. Nothing special. I was very reserved, intelligent but painfully, almost cripplingly shy, full of self-doubt. I never thought I was good enough for anything or anyone. When I looked at my P&L for that event and realized I created 28% profit I was stunned. So, stunned I ran the numbers a second time, then a third time. A got the same result. Everything was paid in full and there was still $425 left over. I had done something WELL and could prove it! The very next day I took the trailer to our “central” park and set up near the playground. I operated a few hours before I had to go to the restaurant and run the closing shift. All by myself I pulled in more profit than I would make that night as a restaurant manager. Of course, the trailer went back Monday morning and it took me another year or so to get all the information, licenses and money necessary to operate under my own business rather than under the restaurant. But I did it. You see in 1981, there was no internet, food carts were a thing in big cities but virtually unheard of in rural America outside of the county fair. Social media was 25 years away, home computers with 20 megabits of memory were still years away from popularity. Every bit of information required time on a landline phone or physically going to the health department, city hall or the fire department. Mobile food vending was so unheard of that most officials I dealt with were clueless as to how to license one. Some permits officials thought I might need had nothing to do with food. On city suggested I needed a door to door solicitation permit! Nearly every code, regulation or restriction has sprang up over time to fill someone’s personal agenda. As rules were added I adapted. The mass of red tape, permits, licenses, restrictions that newbies whine about today were added slowly over time. Death by a thousand cuts for vendors of long tenure. Yet for nearly 40 years I survived it. A newbie should expect:

My advice? Start NOW. Research- read your state's food codes then move to county and city for food vendor restrictions. Note how much all the licenses and permits cost. See what is on the county and city commissioner’s agenda for the coming sessions. You don’t want surprises. Menu- based on your research and state restrictions develop your menu. Think in terms of what is missing from the food scene in your area or what can you measurable do better. More convenient location, higher quality food, better sanitation, faster service. Suppliers- find affordable high-quality food, paper and cleaning supplies as well as services you may need like credit card processing, a commissary, grease disposal etc. Work out the cost for each and shop around for better deals. Location- decide if you will operate at a set location (and where), travel a set route (with locations), vend at fairs, festivals & events, do private catering or a combination of all. Again, track costs involved with each. Once you do open ALWAYS be looking for your next site. Equipment- price used equipment that meets your menu needs. Understand you are purchasing EQUIPMENT not a business. Do not buy new until you have proved yourself in food vending. There are over 3000 used trucks and trailers for sale today. You don't want yours to be one next year. Once you have equipment on order then do all your permits and licenses. Some of your licenses will require floor plans of your equipment that is why you wait till this point for permits. Business Plan- write one. Do the market research, test your food on friends, family, co-workers and at church. Above all make your business plan prove to you the menu and business is viable BEFORE you spend any money. Marketing- Once you start your licensing process also set up and start your social media and overall marketing strategy. Facebook alone WON'T cut it. Mentor- Partner with an experienced food truck operator or food specific business coach to get your questions answered, provide guidance and support. If you want to be profitable from day one you will need the help of experienced folks. Even if you have food service experience at ANY level a vending business is very different. Short order cooking is good experience as is waitressing. Management training is helpful BUT all that experience WOEFULLY under prepares someone for owning and operating your own business. Notice purchasing equipment is NOT the first thing to do. Many people buy equipment then ask questions. By then it is too late. As a business owner you do not want an asset just sitting while you research how to use it. For me the work was always fun. I never once thought I was working hard. I was having fun and getting paid well to have it. |

Bill MI have had a passion for helping people since an early age back in rural Kentucky. That passion grew into teaching and training managers and owners how to grow sales, increase profits, and retain guests. You’ll find a ton of information here about improving restaurant and food cart/trailer operations and profits. Got questions? Email me at [email protected] Archives

January 2023

|

RSS Feed

RSS Feed