|

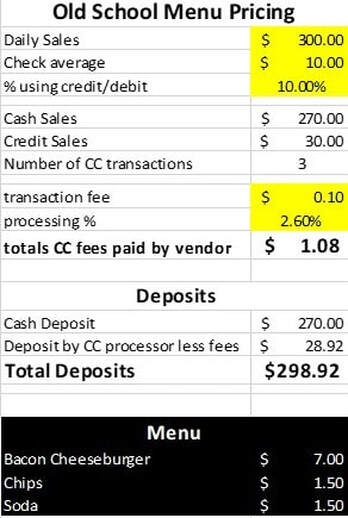

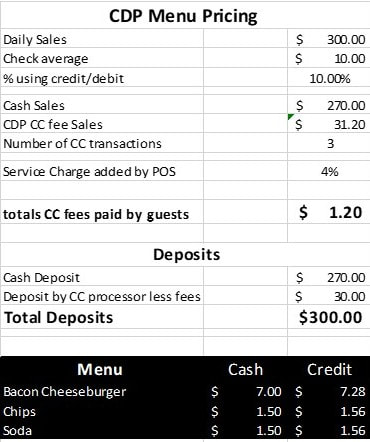

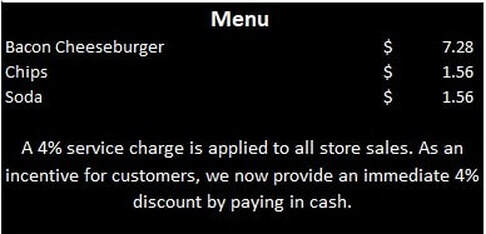

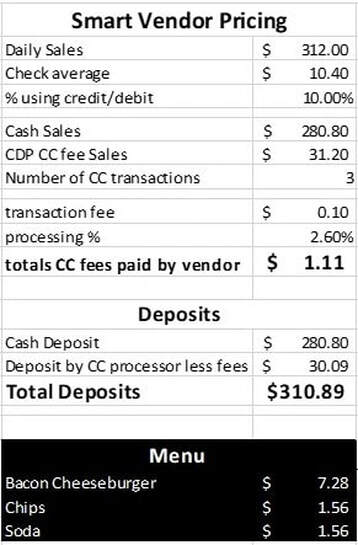

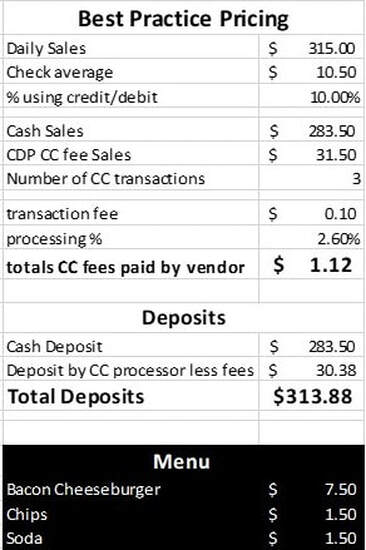

This is one of the three most often asked questions on Facebook groups with the least understanding of what is being asked. Most people really mean to ask, “what is the cheapest way to process credit cards?” A POS (point of sale) system is a computerized cash register. A POS often DOES NOT necessarily have integrated credit card processing. Credit card processing can be completely stand alone from the cash register. A POS can be an app like https://loyverse.com/us/pricing (FREE!) or Square (without using their card processing) or a physical machine like HarborTouch, Posi-Touch, NCR, Panasonic, etc., etc. All the average food vendor needs is basic inventory, net sales, taxes, discounts and sales mix capabilities in a POS. Processing credit cards can also be a part of a POS system or POS app. As can labor/payroll or distributor ordering add-ons or loyalty programs. The most important question – “What do I REALLY need at this stage of my business and how will it impact my profit.” Since over 80% of ALL payroll is direct deposit taking debit and credit is well past mandatory. A cash only vendor is or soon will be dying a slow death. The question is which credit card processor to use. I have already discussed credit cards at length here. This post will be showing the math and impact on your menu of the different payment strategies. Old School Approach  This old school price model shows a vendor using Square as credit card processor. Only 10% of his sales are in credit or debit processing. At the end of the day his bank account would have $298.92 in deposits since the Square would keep $1.08 in processing fees. Meaning the vendor is taking responsibility for processing fees. The guest credit card receipt will not have weasel words to explain an additional credit card fee. If two guests come up and order the same items, one pays cash and the other pays credit, they are charged the EXACT same price. No potential for service slowing complaints. This vendors menu is easy to read no confusing pricing and no easy to overlook disclaimers. Cash Discount Program (CDP)  A cash discount program is offered by several processing companies and utilizes rules allowed by all the credit card issuing institutions. At its basic form a vendor lists their menu pricing to include processing fees (usually 4% above cash price) and then offers a “discount” to guests opting to use cash. Then the credit card processor deposits money less the 4% processing fee. Effectively giving the vendor the same amount of money as if all his guests paid in cash. The menu becomes clumsy to read. Legally this program requires either TWO prices listed - one for cash and one for credit. Just like your local filling station. Or...  Your menu MUST include a disclaimer explaining the service charge and cash discount. Like this one. (Weasel words!) Any vendor with more than a day’s experience knows reading a menu is NOT a guest’s strong point. Let alone any language barrier. Now imagine those same two friends ordering the EXACT same food. One pays with cash and one pays with credit. Do you think for a second that the credit card purchaser will not complain? Even a half-hearted complaint will be heard by other guests and how you handle it will be remembered. No matter what the end result of the conversation may be, you have just increased your service times just to save a few pennies. Not exactly smart business. There will be guests that will happily pay the full amount credit listed on your menu. Think about that. If they happily pay the credit card amount, they are saying your food is worth the price! Then why would you discount someone choosing to pay in cash??? Does your food have less value for them? Smart Vendor Pricing If your guests don’t complain about a 4% service charge being already figured into your pricing, why not just drop the cash discount nonsense, raise your prices officially that extra 4% and you reap the profits rather than the scammer that convinced you use a CDP? In this example you can see the Average check increased $0.40 (4%) to reflect the menu price increase. Look at the deposits for the day. The smart vendor made an extra $10.89 with the exact same guest count. In other words, the vendor DID NOT give away hard earned money to have “free” credit card processing. The menu on the other hand contains pennies. If you are a tax included vendor this scares you. Let’s fix that. Best Practice Vending  A vendor that includes sales tax (or the state does not tax food sales) should price on the quarter. Making for less coin change needed. (Please don’t argue about change slows you down. It DOES NOT.) Be brave price on the quarter. The vendor now receives $13.88 MORE in deposits than if they fell for the “free” processing scams. Compared to the “old school” price model once they accounted for credit card processing in their menu prices, they made $14.96 MORE in deposits. The menu is easy to read with no service charge, cash discount nonsense disclaimer. Two friends ordering the exact same items pay the exact same total, no questions, comments, or complaints. Accounting for credit card processing in your menu prices is just like accounting for the bacon, cheese, meat, bun, condiments, wrapper, napkins, and a carryout bag for your Bacon Cheeseburger. It really is just that simple.

2 Comments

Mae

12/29/2020 02:07:55 pm

Thank you for this detailed explaining! It really helped me out figuring this part of things out!

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Bill MI have had a passion for helping people since an early age back in rural Kentucky. That passion grew into teaching and training managers and owners how to grow sales, increase profits, and retain guests. You’ll find a ton of information here about improving restaurant and food cart/trailer operations and profits. Got questions? Email me at [email protected] Archives

January 2023

|

RSS Feed

RSS Feed