|

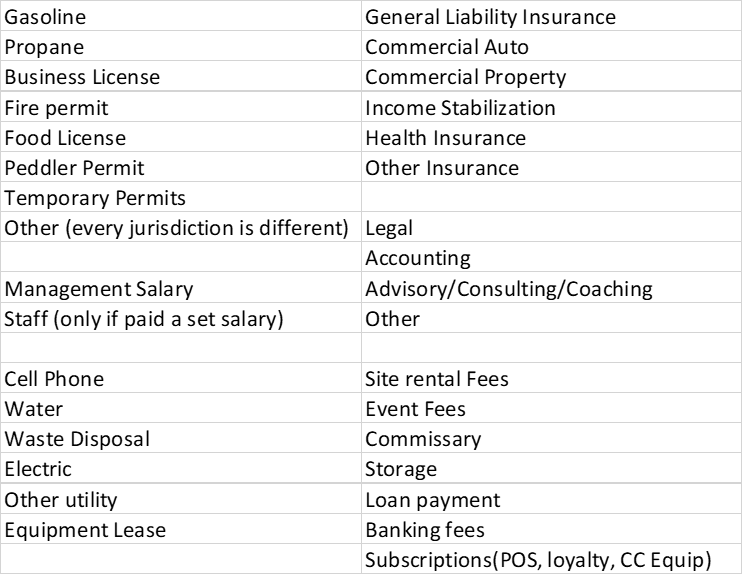

I see this advice offered on groups too often. Yet there is little follow up or explanation on how a newbie could achieve such a lofty goal of 33% profit. Just the vague one-third food cost, one-third overhead and one-third profit. Makes sense, right? It nearly adds up to 100% so the advice must be sound. Anthony Robbins is fond of saying “success leaves clues”, I want to see if the math clues of this one-third - one-third - one-third principle will lead to success. Remember one of the key components of a math formula is it works for everyone, every time. Let us start with 100% revenue – (33.3% food cost + 33.3% profit) = 33.4% overhead. In this formula the know each of those percentages cannot change. If one is changed the others MUST be changed, as well. Math does not adjust answers based on needs or wants. 100% of revenue is all we have to work with, no more and no less. The question is, will all these expenses (listed below) when added together and divided by revenue to equal 33.4%? If you notice most of these expenses have one thing in common. Most are fixed costs. Meaning you will pay the EXACT same amount whether your revenue is $1000 a week or $19,230 a week. In our false profit model ALL of these expenses can be no more than 33.4% of total revenue. Ah, a math formula! (Actually, algebra) f/r=33.4% The first step for us is to find f. That is easy, f represents the total of all fixed costs. Even a brand-new person can make phone calls and use the internet to find the exact cost of each of these expenses listed above. No guessing! In the major cities across the USA, on average ten permits are required costing $1,864. Insurance averages $4,710 annually. Cell phone $298.56 annually for a reliable connection. Banking fees are on average $120 a year. So far we are at $6992.56 and have not even found a place to park (which could have a rent), attended a major event (which can have fees in the thousands), found a commissary, used a lawyer or accountant (expert advice you can’t do without) or paid any POS related subscriptions. PLUS we have not accounted for propane or gasoline. Propane and gasoline are only consumed when our business is open but we can’t generate revenue by being closed. Both are consumed at a predictable rate when we are open. To avoid writing another book let’s just use $6992.56 figure in our formula, which now reads - $6,992.56/r=33.4% Solve for r. r=$20,935.81 double check: $6,992.56/$20,935.81=.33399 or 33.39% Now that we know the revenue we can plug in all the other numbers. Top line sales revenue is $20,935.81 Fixed expenses are $6992.56 (33.39%) Food cost must be $6977.90 (33.33%) Subtracting those expenses from the revenue leaves $6965.35 (33.27%) profit. Close enough, looks like those false profits were right. ☹ Oh wait just one more question. Where are the credit card processing fees? There is no hourly labor, so this must be a solo operation. (At 20K a year in sales it should be a solo operation) Still got to pay those pesky payroll taxes even with one employee. There is no money set aside for repair and maintenance. I wonder how this business is getting guests since there is no marketing money set aside either. You see, every business in the world has only 2 kinds of expenses. Fixed and Variable. A fixed expense has to paid whether the business is open and selling goods and services or not. The dollars spent REMAINS THE SAME however the percentage INCREASES OR DECREASES depending on revenue. When revenue goes up the PERCENTAGE goes down. Hmmm? Starting to see the problem with the false profits model? Variable expenses ride the tide of sales. The dollars spent MUST increase as sales increase otherwise the business has no products to sell. However the PERCENTAGE of sales remains the same. In fact since some costs are fixed there is only ONE revenue amount out of the infinity of numbers will fit anyone’s exact fixed costs and yield a 33.4% “overhead”. Let me share a formula that will actually help you price your menu for profitability AND tell you exactly how much in sales you will need to pay the bills and yourself. It is called the BREAKEVEN formula. It is based on real numbers that apply to exact one business, YOURS. I have a spreadsheet that is a part of The Ultimate Food Truck Training Course that walks you step by step on determining your breakeven point. Here is the breakeven formula: f/(1-v%) = b f is the total of ALL your fixed costs listed above. Fixed costs are then divided by the difference of 100% less the total of ALL your variable expenses as a percentage. The answer is the exact sales point where your business has enough sales to pay all the bills. This number can be figured annually, monthly, weekly, daily. I recommend daily until you have a firm grasp on your business expenses and sales. The best thing is you only need to figure this number once it will never change UNLESS your fixed costs change or you find your variable cost goals are not being achieved. So? How does all this mumbo jumbo help you determine your menu prices? Let’s go back to this number from earlier, $6992.56. Let’s just assume that covers all the fixed costs our business will encounter in one month. On the surface it seems all we need to do is generate that amount of sales and everything is paid right. Not quite. In order to generate sales we must consume inventory and other supplies, as well as, pay employees. Each of those expenses mentioned are variable, meaning as you sell a product your expenses effectively increase in dollars. BUT should remain the same percentage wise. The question is what is that percentage for all those variable expenses? You have to start somewhere so let’s start with what the pros (chain restaurants selling similar foods) use for their variable costs. I have worked with all the biggest sandwich chains. I’ve seen the changes in costs over the decades. A general rule of thumb is to start at 50% for food and TOTAL labor (salary and hourly). Notice SALARY that means paying yourself! Salaries, technically, are a fixed cost. Just to show you can pay yourself let’s add a nice salary of $1,000 a week to the fixed cost above. New total - $10,992.52 Since we are taking the salaries and putting them in fixed costs what does that do to the 50% food and labor variable cost? Let’s just pick a random number and see what happens. Put food at 25% with hourly labor and payroll taxes at 15%. Set budgets (as percentages) for cleaning supplies (.40%), office supplies (.20%), repair and maintenance (to set aside for when you need to spend it – 1%) and marketing (2%). Adding those percentages together we get 43.6% which when put into the breakeven formula equals – revenue to pay all the bills and yourself - $19,490.28 per month. EVERY dollar above that amount is $0.56 profit! Here is the double check – Revenue $19,490.28 Fixed Costs - $10,992.52 (56.40%) Variable Costs - $ 8,497.76 (43.60%) Profit/loss 0 If you plan on working 20 days a month, you need only $974.51 per day. Now take your average check to determine how many guests you need per day. Let’s say your average check is (or will be) $12.00 that means you need just 82 guest per day. Now your marketing focus becomes “how can my marketing generate 82 guest visits a day?” Remember you market to people showing how you can satisfy their needs. In food service that need is time bound hunger. Meaning fast, friendly service delivering delicious food from a sanitary environment. It really is just that simple. Now that you know what it takes to breakeven you also established your food cost goal. Twenty five percent. You could adjust that food cost percentage up or down at this point to raise or lower your breakeven point. Lower your goal food cost percentage to 20% and your breakeven point goes to $895.16 (75 guests) a day. Or raise it to 33% and your breakeven goes to $1135.59 (95 guests) a day. The only question at this point is will guests find your food worth the price you will charge. Remember value is not only in portion size but also, flavor, quality ingredients, convenience of location, and fast, friendly staff. Remember, in this example we are paying ourselves $1,000 a week. Anything above the breakeven could be re-invested in the business, set aside for business emergencies or paid out as bonuses to the owner and staff. I know you want to see what the false profits proponent’s model would require for daily sales. To make this fair we will remove the salary. Making the fixed cost return to $6992.52. Adding in the 33% profit means you need $2270.30 in sales or 190 guests a day. The question is do you want to stress getting that many people to eat with you every single day? After all the mathematical gymnastics we still have not priced a menu. That is easy. Want to run the 25% food cost that we just proved can pay a salary and has a low threshold guest count? Total all the ingredients and paper required for each menu item and multiply by at least four. 20% in your sights? Multiply by five. The last number in the equation is the average check. As a newbie you have no data to know what your guests are willing to spend. We can’t focus on what we don’t know, we must focus on what we do know. Designing a menu layout is another post, rest assured you can influence what is ordered and with suggestive selling hit your goal average check. Need help? Get on my schedule with a free no obligation one-hour consultation. Ask all the questions you need answered. NOTE: Yes, I know the difference in profit and prophet. We are in business. We want profit. I thought it was a cute play on words.

0 Comments

Sounds awesome, right?Let me share an unfortunate business fact... Owning a food truck and surviving into the fourth year ain’t easy. Especially if you have little food service experience and/or no business experience. The trick is how do YOU beat those odds? I know YOU want to join the ranks of the SUCCESSFUL 40%, right? So, let’s get down to it… When someone says their dream is to operate a food truck, my first question is always “why?” The reason always boils down to “short term problem creates high motivation for personal change”, but and this is a BIG BUT, often the person has little industry knowledge and little to no business experience. “The Great Food Truck Race” makes it look easy, right? Many folks never have any real success in food trucks because first, they don’t have a plan or the worst decision of all… just jump in buy a truck THEN figure out what to do. In every case this lack of knowledge is costly, frustrating, and highly inefficient. If the first thing those folks did was buy a food cart or trailer, they have ALREADY wasted considerable time and resources. They own an expensive asset just sitting collecting dust as they “figure it out”. Food service is all about efficiency – no wasted time, money, product, or effort. If you have been thinking about opening a food truck (trailer or cart) you are at the IDEA stage, so let’s refine your idea just a bit… IDEA - Imagine what type of vending you would love. Commercially packaged snacks & drinks. (i.e. Ice cream truck) or Minimal risk or commercially pre-cooked foods. (i.e. funnel cakes, kettle corn, hot dogs) or Full prep including cooking raw proteins. (i.e. tacos, burgers, BBQ, etc.) Each of these will have different rules based on your state laws and regulations. Oh, and county & city level rules, too. Some states have a different license for each of those vending types and even various levels within those different categories. There are some states that do believe in simplicity having only one or two license types. Luckily, there is only one Federal level task you need to complete, and this is getting your EIN. Don’t know what that is? That is where STEP 2 comes in. More on that in a moment. Imagine working each of those different vending types. Which one excites you and makes you want to start RIGHT NOW? Let me caution you if your first thought is “which one makes the most money?” You are already headed down the wrong business path. Food service at any level takes a commitment of challenging work, long hours and dealing with a hungry (and often grouchy because they are hungry) public. The most successful vendors have a love of cooking, serving the public and are students of the industry, educating themselves daily. Yes, learning and improving never ends! Once you know which vending type is a perfect fit for you move on to… LAWS - Research state, county, and city laws.Laws on food, peddling, vending, safety, fire, taxes, etc. * Go to your favorite search engine and search your town or city by name and add “starting a business”. Look for checklists on what is needed, as well as, lists of office/department names and officials you will need to contact. * Repeat the same search at the county level as well. * Search for your state’s department of revenue and research starting a business at the state level. * Go to the IRS.gov web site and search for starting a business and follow its links. This is where you will find the EIN (Employer Identification Number). There’s the answer!!! If you need clarification call an official and ask all the questions you have. Remember, YOU are gathering all the pertinent information BEFORE spending money. Only go to official state, county & city sites. Sites usually end with .org, .edu, .gov, or, .state.us (i.e. fl.us) Ad sites like legalzoom.com will come up above official sites. The ads are designed to sell services you don’t need right now or perhaps never. Often the ad sites contain very outdated information, broken links or even attempt to look “official”. Remember only go to verifiable official city, county, and state government sites. By this point you have a few hours invested in research and should have a general idea about regulatory costs before making the big purchases of a vehicle and supplies. Keep a list of all the costs for each permit or license, you’ll need it later when you write your business plan. You must understand your area’s regulations to operate within those regulations. Take all the time you need to study those laws, regulations, and state level Food Code. Understanding your rights and limitations within those local rules will save you future headaches. Here are a few places to call or search online:

Once the research is complete it is time to figure out what food to sell, remembering your vending type and the rules you just researched. MENU - What will you sell? The only question that matters at this point is: What is missing from your local food scene that you would be proud to sell and is within your current skill level? No matter how awesome your BBQ may taste if you enter the field as the 27th BBQ truck in your area it will take time to establish yourself. Do you have the time and money to build your brand up to the sales level you need? If you do, GREAT! If not, look at other foods that meet the question – “missing from the food scene”, “proud to sell” AND “within your current skill level”. “Missing” could also mean underserved. If your city population is 10 million being the 27th BBQ truck is probably not a bad thing. The key point here is filling a food need in your area will help get you off the ground faster. People will try your food at least once if it is something they can’t easily find elsewhere. Then it is up to you to encourage repeat visits by combining delicious food with great service. “Proud to sell” keeps you focused on quality. Which in turn will reward your bank account. “Current skill level” helps reduce your frustration as you are learning other necessary skills, like bookkeeping, marketing, inventory, sanitation, guest service. The last thing you need is to also learn a new cuisine, too. You can always expand your cooking skills once the business is off the ground. Once you have the “what” of your menu next is finding a supplier or three for your food. Warehouse stores are the place first timers turn. A Sam’s Club, Costco or BJ’s are often found in most towns. Bigger cities may have a Restaurant Depot. Of course, there are big suppliers that may deliver to you. (Sysco, US Foods, GFS, Chaney Brothers) You could order online from a site like https://www.webstaurantstore.com/ as well. Now that you know what you are selling and where you will get your supplies, it is time figure your portions and costs. Down to the ounce and specific recipe amounts. List everything even salt for fries. Don’t forget paper serving products, straws, napkins, etc. You will need to know this information for the next part of the menu process and the one most newbies struggle with the most: Pricing your menu! Many newbies tend to under value their menu believing price is the only driving factor in choosing a place to eat. The problem is they are looking at pricing through the lens of their own life experience and spending habits. Or they seek online advice and are told “three times cost” is the rule of thumb. It was in 1980. I was there then. In 2020 figure prices at a MINIMUM of 4 times cost with 5 or 6 or more times for certain items. Finally, after figuring your food / paper costs, portioning, and menu price, all that is left is to consider how you will cook your foods and on what equipment. Everything will need a storage home too. As in hot holding (i.e. steam table), cold holding (i.e. condiment station, freezer, refrigerator) and dry storage shelving needs. Don’t forget utensils, scales, and other small wares (pots, pans, lids, plastic storage). Make a list, you’ll need that later too. Besides food to sell there are a few other supply and service necessities… SHOP - Supplies and Services You already know you need food and paper products to sell, right? But there are other products and services you need. What about clean up, sanitation, a place to store and prep food, an attorney, accountant or even a repairman? Some of those you will need daily, others only occasionally, and a few (hopefully) rarely. Setup these services BEFORE you have an emergency and need them. Emergencies force bad and expensive decisions. In no particular order you will need, at the very least, a(n):

This is the point where you can make an informed decision on your official business organization. There are 4 main types: sole proprietorship, partnership, corporation, and Limited Liability Company (LLC). Each of these also have a corresponding Federal Tax filing status except LLC, if you are an LLC you get to choose between your filing as either a corporation or sole proprietor. Talk to an attorney or accountant about these crucial decisions. Each of those business organizations have different rules and obligations for each state. The only people capable of giving you great legal advice are the professionals from your area that are also aware of your personal and financial needs. Final word… be extremely careful of whom you seek counsel when you get to the Advisor/Mentor part. Joining a food truck group on Facebook is a wonderful place to find support, however, not everyone in those groups is experienced, knowledgeable or principle centered. Often groups have trolls posting bad advice and insulting honest newbie questions just for laughs. Look at the admins of the group and check their profile. In 90% of the cases the admins don’t even list their own vending business in their work history. Any illegal, bad, or fraudulent advice is often ignored because the admins simply don’t care or know any better from their own lack of industry experience. Newbies will ask a simple question like “what is the best POS?” and invariably a dozen or more people answer “Square”, yet most of those people have never tried more than ONE system. These types of questions are really popularity polls, as opposed to reviews revealing the best out of the 50 or so POS systems a food vendor could choose. Popular does not equal BEST. Take all advice with a grain of salt. Likewise, other social media platform groups are also a gamble as to whether the information is valid or from an attention seeking troll. This group (in my humble opinion - THE best group) has admins with a combined seventy plus years in food service and street vending. It is a highly moderated, social learning group, full of teaching posts called “Units” as well as the general discussion area. WHERE - One or several venues to sell your food. Vendors need a safe and publicly accessible site to create daily income, however, the most profit is found vending at large public events. Don’t forget catering and private corporate gigs. Of course, there is the venerable route driving like an ice cream truck, as well. All of these are viable sources of income. Pick one or all as your business model revenue stream(s). First you must deal with the limitations placed on street vending by your town. All that research you did earlier comes into play now. You may have found limits on where you can set up, how many hours you may stay in one spot or that your town has a wait list for vending permits. If you can vend daily, you will need a place (or places) to set up or a route to drive. Make a list of places you would like to explore. Places that already have people gathered to shop or work. Such as: grocery stores(Kroger, Publix, H-E-B), Dollar stores (General, Family, Tree), big box stores (Best Buy), hardware stores(Ace, Lowes, Home Depot), furniture stores, vacant lots on high traffic streets, public gathering places (parks, boat launches, beaches, lakes, swimming pools, sporting events, kids sporting events/practice fields), court houses, large office buildings, construction sites, large home owners associations, call centers, distribution centers (Amazon, Fed Ex, UPS) hospitals, medical centers, shopping centers, boardwalks, car dealer ships, auctions, flea markets, industrial complexes, ship yards, malls, outlet centers, car washes, etc. Don’t overlook Apartment complexes, Homeowner Associations, and RV parks. Don't stop until you have one hundred potential places to vend. If you live in a small-town shoot for fifty. They are there, just look. Weed out the list by visiting the location during the times you wish to vend and observe foot traffic and vehicle traffic patterns. Talk to employees, security guards and customers of the business. Is the business as busy (or slow) as it appears on the day you visit? Is delicious food readily available nearby? Count foot traffic while you are there. Also look up vehicle traffic on your state DOT website or ask a real estate agent for demographics. Vehicle traffic is important for your advertising & signs getting people to notice and remember your business. You will need at least two hundred people an hour passing by to make the site potentially profitable. (The more the better) Call all the promising locations and ask to speak to the person having the authority to authorize a food vendor on site to feed customers and employees. You will have lots of “No” replies before finally getting one “yes”. An EVENT in street vendor parlance is a vending opportunity taking place at a locally or corporately sponsored occasion designed to celebrate or highlight some aspect of local or business life. These occasions draw people to a large outdoor site where games, rides, arts, crafts, concerts, petting zoos, comedy acts, local harvests, general entertainment, exhibitions, and other activities are presented for the enjoyment of attendees. Notice that food is NOT a primary reason people attend events. Every state and many counties have these large events that last from a single weekend to 2 weeks or more. The draw in these events is NOT food vendors. The focus for attendees is on ALL the other activities and food vendors are just a simple convenience necessary for the attendee’s overall enjoyment of the event. Many food vendors look at events as a money grab and do not really try to operate in a safe, sanitary, and guest centric manner. The opinion of these food vendors is “one and done” treatment of their guests. These poor vendors do not attempt to build repeat business, often having ridiculous long lines and bragging about it as if their food is so good people can’t live without it. Guess what the event promoter will do next year? Add more food vendors to keep the lines shorter. Remember people standing in line to buy your food aren’t spending money where the promoter wants them to spend money. Long lines encouraged the promoter to add more food vendors or require a percentage of sales in addition to other fees. If you don’t see the problems with operating in a “one and done” fashion, expect to be one of the 60% failures mentioned earlier. Catering and private gigs are great sources of revenue as well. Adding a simple “We Cater” on your vehicle and business cards opens those business opportunities. But we do need something to cook in and on… EQUIP - your business. Before we start looking at carts or trailers, I want you to understand you are NOT BUYING A BUSINESS. You are buying a piece of equipment for your business. Food service, street vending, catering & restaurants are all about delicious high-quality food, delivered by fast and friendly staff in a clean and sanitary environment. Based on your local rules and laws (you researched earlier) and the menu (you designed earlier), what equipment did you deem necessary? Remember the list you made? Have that list in hand when you start shopping. Set an equipment budget and stay within it when you shop. Budget determines new or used equipment. DIY is an option if you have the skills and time to build. For my money, purchasing used is the way to go. But if new is what you want, consider the following and tread carefully while shopping. Trailer and truck manufacturers have different standards for the same products. For example, do they build from the ground up or buy and convert a simple cargo trailer? Cargo trailers are not braced to hold exhaust hoods or air conditioners. Cargo trailers generally are not insulted so they heat up like a tin can sitting in the sun. When the cooking starts it gets worse! Cargo trailers are often made from wood, not sealed on the underside, have stiff or little shock absorbing capabilities. Make sure you understand what you are buying. Don’t fall for manufacturer sales pitches. You have done your homework on what is needed to legally start your business as well as, what is required by regulatory agencies. Your equipment must meet those requirements. Manufacturers will state they will (or have) worked with all the various health departments and their designs will pass inspections. However, buried in the paperwork will be a disclaimer putting the final approval on you, regardless of if it will pass the “mean old” health department or not. Get started with your purchase based on your budget. If you must have a new cart or trailer, factor in shipping or pickup and turnaround time. Assume they will miss the promise date. Read everything you can find about the manufacturer BEFORE ordering. Every manufacturer has good and bad points. Besides the trailer you will need small wares. Again, shop used restaurant supply stores and check local equipment auctions (if you have them). It could be the difference in you paying $7.00 for a single pan or getting half a dozen for a $1.00. Being frugal with equipment purchases allows you more spending flexibility with your food, paper, supplies and last-minute expenses that invariable creep up. PLAN - Write a business plan “Do I really need a business plan?” If you have to ask you aren’t ready to run a business. Every profitable business has a plan. Even the ones that brag about not having a plan. Their plan is to join the 60% of business failures. A business plan is an ever-changing document, often morphing into something completely different than originally written. Research will only take you so far. Practical application of your plans will change and grow as you gain real world experience. The core business plan framework will remain, and many elements will continue to work well after opening day. A business plan is your opportunity to prove to yourself as well as any commercial, angel or family investors that the business idea is operationally sound and profitable. Buying a bunch of cooking equipment and tossing it in a trailer with a couple hundred dollars of food is not a business. It is a recipe for financial disaster and embarrassment. Many food vendors barely survive often depending on ever diminishing cash flow rather than profits to stay viable as a business. Riches do not come by crossing your fingers and walking through the day hoping. Riches and wealth come from well-laid plans. - Jim Rohn People come in with business plans and, I mean I know that no one is going to meet everything they say in a business plan, but you got to have something to guide towards. - Arthur Rock Small businesses, you can give them capital, but what they often need as much is mentoring, advice and help with their business plan. - Karen Mills All those lists and notes you have been writing come into play as you start your business plan. The key elements of a food business plan are: Executive Summary

DO NOT USE A BUSINESS PLAN WRITING SERVICE. Your business plan is too important to delegate to a stranger from some other area. You have expertise and knowledge about your area that a writing service simply cannot Google. Likewise, your passion for your food and business could never be expressed by anyone other than you. MARKET - Let people know you exist and invite them. the world of the small food business operator, marketing is simply the invitation to “please eat my food.” The “invitation” is extended via branded umbrellas, A-frame signs, feather flags, flyers, menus, business cards and having an inviting set up. Once your guests RSVP your invitation it’s all up to your impeccable service, high quality and shining sanitation to encourage a big purchase AND develop a loyal repeating guest. Each of these elements (QSC) reaffirms your guest’s decision to choose you as their next meal. Once you understand marketing is a 24/7 job and you are actively marketing every working moment your business will flourish. Here is a shortish list of Marketing tips and must dos: Social media is necessary. Facebook and Twitter at the very least. Instagram is the hot media right now for food vendors. Pictures do the selling for you. Use some type of guest loyalty program. Punch cards where your guests get a free something after purchasing a certain number of the something work quite well. There are many subscription-based loyalty programs available with many POS systems. No cards to lose! Bounce back coupons. A bounce back coupon is a coupon you give guests that visit today to encourage them to “bounce back” sometime in the future. Print and passing out flyers is a wonderful way to meet businesses near your location. Signage. On location, you will need at least one sign with a product and a price point. Feather signs, lighted arrows, windsock, yard signs and umbrellas with logos all help define what you are selling and draws attention to you. Flash = Cash. A well-lit trailer with a colorful wrap commands attention. Instinctually humans are drawn towards things that make us feel good. Community Involvement. Involvement in your community will do amazing things for your sales. For example, setting up fund raisers for schools and civic organizations Apps. There is an ever-expanding group of food truck/cart related apps. They help with social media posting, posting current locations, push notifications, and getting bookings for events and catering. Website. Many food vendors only web presence is Facebook. While Facebook is a “must do” as far as business promotion, it SHOULD NOT be the only way. Facebook (and all other social media platforms) own all your content and if they decide to ban your business page because you supported a controversial politician or took an unpopular business stance all your marketing presence there disappears. A word of caution – when you start a new business it becomes a target for salesmen. They will circle like vultures offering any and every service and product. Many of which your new business will need to grow into before realizing the full benefit of those services. Credit card processing and social media services are just two of many that will beat down your door or blow up your phone to offer their wares. Be selective and only purchase AFTER you have time to research and sleep on it. Any salesman that wants an immediate answer is more interested in their own commission than your business’s wellbeing. If they say the price goes up tomorrow just hang up. It is an artificial emotional sales tactic. Also be extremely skeptical of any business website that does not display pricing. If you must set up "demonstrations" or "we will call you soon" without prior notification of price you can rest assured the price is higher than other services. Those salesmen or affiliate representatives are paid commissions, guess who is really paying the commission. Food service is about efficient use of resources. If a company wanting my business forces me into some "sales funnel" scheme, that company does not fully understand the food business and does not deserve my money or yours. MENTOR - Find one from the industry Inexperienced food service owners need help, especially if they're new to starting and growing a business. Newbies may seek help from more experienced vending colleagues who can teach based on their own experience or a newbie may seek guidance from professionals (like the SBA) who've had business experience. (but not necessarily food business) You will find some food truckers to be open and honest with advice and willing to help you get started. While other vendors look at you as competition and refuse to help or worse give you bad advice. (remember the Facebook trolls from earlier?) As a newbie telling the difference in good advice and bad is difficult. Seek your food truck advisor and business coaches very carefully. The keys elements are: Formal Food Training. There is a small handful of vendor specific training available. Such as Hot Dog University which is sponsored by Vienna Hot Dogs. The best alternative is formal restaurant training for managers. Chef or employee level experience is nice but lacks concentrated business training. Formal Trainer Training. Currently in the US there are tens of thousands food managers at all levels. Ninety percent of those received formal training from a corporately trained trainer. Those trainers know food service and know how to communicate that knowledge to trainees. Experience. Across distinct types of vending and locations. What works in rural Tennessee simply does not translate to downtown Miami. Coach mentality. A coach holds you responsible for your results. Keeping you focused on your goals. Providing the kick in the pants when you need it and cheerleads the celebration for your successes. WARNING - What you don't know will hurt......your business and your bank account. I have a solution to help you succeed at a price you won't believe! The Ultimate Food Business Training CourseA 250+ page textbook PDF you can put on any device and study anywhere. Inside you’ll find in depth details on:

PLUS - Bonus sections on Catering, Starting with Little Cash, Understanding Credit Card Processing, Vehicle Security and more. An 80+ page printable workbook and study guide to keep you on track towards your goals

But you’ll need more than just a book to be successful… To get you profitable fast I am including: Over a dozen Word Document and Excel Spread Sheet Templates covering important facets of your vending business:

PLUS – A Food Truck Business Plan template with an Excel financial projection template. The template includes instructions and examples of what you should write plus the Excel spread sheet helps guide you on your financial projections. PLUS – 8 hours of one-on-one food vending training. Ask all the questions you need answered, get the necessary guidance when you hit roadblocks, as well as encouragement and a kick in the seat of the pants if you need it! My goal is to see you in that successful 40% three years from today! Get the most comprehensive food truck training program on the planet! Limited amount available. (I can only help so many people) Download TODAY! ONLY What are you waiting on???  What!? Think about it. A commercially produced fully cooked hamburger patty sold from a hot dog cart. There are a few sellers out there bending or completely breaking their state rules by selling these products. One NJ seller is heating them up in the same “dirty water” as they heat their hot dogs (I hate that term! It is such a negative anti-sanitation term, yet vendors bandy about the term proudly like a badge of honor). Then once they feel the patty is hot enough, they transfer it to a dry holding pan using aluminum foil to “keep the pans clean”. OK, it is precooked right just like a hot dog, so what is the big deal? First, using the same water for hot dogs and hamburgers muddies the flavor of both products. Both meat products leach out fats, seasonings and flavors into the water. That is what gives the water that name – “dirty water”. Meaning the busier the vendor the more alike the hot dog and hamburger will taste. Would you like to eat a hot dog flavored hamburger? Seasoning the water in an attempt to control the taste will have vastly different impact on a hamburger than a hot dog. Remember hot dogs are encased which shields the internal meat from the added water seasoning. While a hamburger is “unprotected” and will absorb more of those seasonings and all the leached hot dog flavor. Most state allow hot dog vendors to operate under extremely specific rules. Those rules often limit what they can cook with wording in their food code similar to this from Kentucky: “Section 4. Restricted Concessions. (1) Restricted concessions may include: … (h) Pre-cooked, commercially processed hotdogs, frankfurters, or similar meats (such as bratwurst or Italian sausage) that are grilled, steamed, or boiled on-site” Note that is very a specific description. That section describes the only allowed foods a restricted concessions (hot dog cart) can sell. Letters (a) through (g) and (i) thru (m) list other common road side foods such as flavored & shaved ice, snow cones, pork rinds, peanuts & other shelled nuts, nacho cheese & chips, cotton candy, pre-packaged sandwiches, pre-packaged ice cream and other commercially packaged snacks and finally shelf stable baked goods. Hmmm, no mention of hamburgers. Even trying to weasel around the wording “pre-cooked, commercially processed” and apply it those pre-cooked hamburgers won’t work because of the specific description and shape of the allowed meat. So clearly Kentucky is out. But what about New Jersey? Here is a Salem county handout for mobile vendors: “5. Cooking: You must have a food thermometer onsite and monitor food temperature. A thermocouple is required for all thin foods. The following chart will tell you the minimum temperatures required for cooking: · Hamburgers or other ground beef: 155º F · All poultry products (chicken, etc.) 165º F · Pork or any food containing pork 145º F · Other meats (including seafood) 145º F If you will be holding potentially hazardous foods hot, a minimum of 135º F is required in all parts of the food at all times. Heat lamps and sterno are not recommended as they rarely work. The temperatures are based on known risks and must be followed. 6. Reheating: If you must reheat a potentially hazardous food for hot holding, the food must be reheated quickly to an internal temperature of at least 165º F. Do not reheat foods in crock pots, steam tables or over sterno.” Key points - a hamburger must be cooked to at least 155° (actually the full code reads must maintain that temperature for 15 seconds) or if you consider the fully cooked hamburger patty as a simple reheat, it must reach 165°. Except what does it specifically say? Do not reheat foods in crock pots, steam tables or over sterno. What is a hot dog cart? A rolling steamtable. Another vendor is considering adding this hamburger to their menu in Michigan. He plans on not telling his health department about the addition. No big deal, right? It is a big deal. Michigan food code requires mobile vendors to report ANY additions to their menu and seek approval before adding the item. 1. Food (Note: Any changes to the menu must be submitted and approved by the regulatory authority (LHD or MDARD) prior to their service, you may be required to show approval during inspections.) I would not want to add something and then prove the approval during an inspection. If adding a product requires Health Department approval, then that rule must be followed. Otherwise the ethics of the vendor comes into question. Once ethics can be questioned then other important qualities of success start to fail as well. In fact, ignoring government rules is one of the top three ethics violations a failing business commits. It’s only food what is the big deal? Food laws and health codes are written to protect the weakest members of the public at large from sickness or even death from eating improperly cooked food. Those rules are written so specifically and so strictly in order to prevent an under-educated vendor from selling food that could make someone sick or even kill them. Oh yeah, insurance won’t cover illegal acts, guess who foots the bills if you add an unapproved item to your menu that someone gets sick? That LLC “personal asset protection” evaporates too. Yes, I grew up eating raw cookie dough, and licking the bowl of egg laden cake batter and I survived BUT there are many, many people that could not survive eating an improperly reheated hamburger that has been stewed in dirty hot dog water. Playing Russian Roulette with some else’s health is simply not good business. |

Bill MI have had a passion for helping people since an early age back in rural Kentucky. That passion grew into teaching and training managers and owners how to grow sales, increase profits, and retain guests. You’ll find a ton of information here about improving restaurant and food cart/trailer operations and profits. Got questions? Email me at [email protected] Archives

January 2023

|

RSS Feed

RSS Feed