|

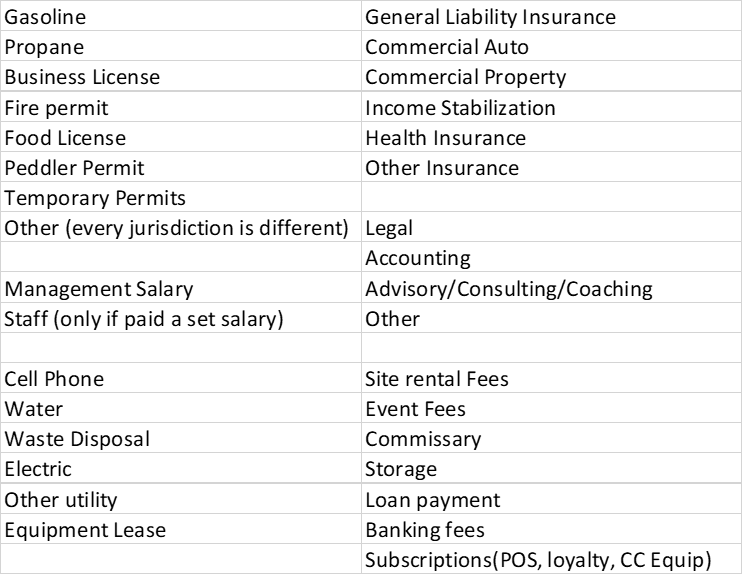

I see this advice offered on groups too often. Yet there is little follow up or explanation on how a newbie could achieve such a lofty goal of 33% profit. Just the vague one-third food cost, one-third overhead and one-third profit. Makes sense, right? It nearly adds up to 100% so the advice must be sound. Anthony Robbins is fond of saying “success leaves clues”, I want to see if the math clues of this one-third - one-third - one-third principle will lead to success. Remember one of the key components of a math formula is it works for everyone, every time. Let us start with 100% revenue – (33.3% food cost + 33.3% profit) = 33.4% overhead. In this formula the know each of those percentages cannot change. If one is changed the others MUST be changed, as well. Math does not adjust answers based on needs or wants. 100% of revenue is all we have to work with, no more and no less. The question is, will all these expenses (listed below) when added together and divided by revenue to equal 33.4%? If you notice most of these expenses have one thing in common. Most are fixed costs. Meaning you will pay the EXACT same amount whether your revenue is $1000 a week or $19,230 a week. In our false profit model ALL of these expenses can be no more than 33.4% of total revenue. Ah, a math formula! (Actually, algebra) f/r=33.4% The first step for us is to find f. That is easy, f represents the total of all fixed costs. Even a brand-new person can make phone calls and use the internet to find the exact cost of each of these expenses listed above. No guessing! In the major cities across the USA, on average ten permits are required costing $1,864. Insurance averages $4,710 annually. Cell phone $298.56 annually for a reliable connection. Banking fees are on average $120 a year. So far we are at $6992.56 and have not even found a place to park (which could have a rent), attended a major event (which can have fees in the thousands), found a commissary, used a lawyer or accountant (expert advice you can’t do without) or paid any POS related subscriptions. PLUS we have not accounted for propane or gasoline. Propane and gasoline are only consumed when our business is open but we can’t generate revenue by being closed. Both are consumed at a predictable rate when we are open. To avoid writing another book let’s just use $6992.56 figure in our formula, which now reads - $6,992.56/r=33.4% Solve for r. r=$20,935.81 double check: $6,992.56/$20,935.81=.33399 or 33.39% Now that we know the revenue we can plug in all the other numbers. Top line sales revenue is $20,935.81 Fixed expenses are $6992.56 (33.39%) Food cost must be $6977.90 (33.33%) Subtracting those expenses from the revenue leaves $6965.35 (33.27%) profit. Close enough, looks like those false profits were right. ☹ Oh wait just one more question. Where are the credit card processing fees? There is no hourly labor, so this must be a solo operation. (At 20K a year in sales it should be a solo operation) Still got to pay those pesky payroll taxes even with one employee. There is no money set aside for repair and maintenance. I wonder how this business is getting guests since there is no marketing money set aside either. You see, every business in the world has only 2 kinds of expenses. Fixed and Variable. A fixed expense has to paid whether the business is open and selling goods and services or not. The dollars spent REMAINS THE SAME however the percentage INCREASES OR DECREASES depending on revenue. When revenue goes up the PERCENTAGE goes down. Hmmm? Starting to see the problem with the false profits model? Variable expenses ride the tide of sales. The dollars spent MUST increase as sales increase otherwise the business has no products to sell. However the PERCENTAGE of sales remains the same. In fact since some costs are fixed there is only ONE revenue amount out of the infinity of numbers will fit anyone’s exact fixed costs and yield a 33.4% “overhead”. Let me share a formula that will actually help you price your menu for profitability AND tell you exactly how much in sales you will need to pay the bills and yourself. It is called the BREAKEVEN formula. It is based on real numbers that apply to exact one business, YOURS. I have a spreadsheet that is a part of The Ultimate Food Truck Training Course that walks you step by step on determining your breakeven point. Here is the breakeven formula: f/(1-v%) = b f is the total of ALL your fixed costs listed above. Fixed costs are then divided by the difference of 100% less the total of ALL your variable expenses as a percentage. The answer is the exact sales point where your business has enough sales to pay all the bills. This number can be figured annually, monthly, weekly, daily. I recommend daily until you have a firm grasp on your business expenses and sales. The best thing is you only need to figure this number once it will never change UNLESS your fixed costs change or you find your variable cost goals are not being achieved. So? How does all this mumbo jumbo help you determine your menu prices? Let’s go back to this number from earlier, $6992.56. Let’s just assume that covers all the fixed costs our business will encounter in one month. On the surface it seems all we need to do is generate that amount of sales and everything is paid right. Not quite. In order to generate sales we must consume inventory and other supplies, as well as, pay employees. Each of those expenses mentioned are variable, meaning as you sell a product your expenses effectively increase in dollars. BUT should remain the same percentage wise. The question is what is that percentage for all those variable expenses? You have to start somewhere so let’s start with what the pros (chain restaurants selling similar foods) use for their variable costs. I have worked with all the biggest sandwich chains. I’ve seen the changes in costs over the decades. A general rule of thumb is to start at 50% for food and TOTAL labor (salary and hourly). Notice SALARY that means paying yourself! Salaries, technically, are a fixed cost. Just to show you can pay yourself let’s add a nice salary of $1,000 a week to the fixed cost above. New total - $10,992.52 Since we are taking the salaries and putting them in fixed costs what does that do to the 50% food and labor variable cost? Let’s just pick a random number and see what happens. Put food at 25% with hourly labor and payroll taxes at 15%. Set budgets (as percentages) for cleaning supplies (.40%), office supplies (.20%), repair and maintenance (to set aside for when you need to spend it – 1%) and marketing (2%). Adding those percentages together we get 43.6% which when put into the breakeven formula equals – revenue to pay all the bills and yourself - $19,490.28 per month. EVERY dollar above that amount is $0.56 profit! Here is the double check – Revenue $19,490.28 Fixed Costs - $10,992.52 (56.40%) Variable Costs - $ 8,497.76 (43.60%) Profit/loss 0 If you plan on working 20 days a month, you need only $974.51 per day. Now take your average check to determine how many guests you need per day. Let’s say your average check is (or will be) $12.00 that means you need just 82 guest per day. Now your marketing focus becomes “how can my marketing generate 82 guest visits a day?” Remember you market to people showing how you can satisfy their needs. In food service that need is time bound hunger. Meaning fast, friendly service delivering delicious food from a sanitary environment. It really is just that simple. Now that you know what it takes to breakeven you also established your food cost goal. Twenty five percent. You could adjust that food cost percentage up or down at this point to raise or lower your breakeven point. Lower your goal food cost percentage to 20% and your breakeven point goes to $895.16 (75 guests) a day. Or raise it to 33% and your breakeven goes to $1135.59 (95 guests) a day. The only question at this point is will guests find your food worth the price you will charge. Remember value is not only in portion size but also, flavor, quality ingredients, convenience of location, and fast, friendly staff. Remember, in this example we are paying ourselves $1,000 a week. Anything above the breakeven could be re-invested in the business, set aside for business emergencies or paid out as bonuses to the owner and staff. I know you want to see what the false profits proponent’s model would require for daily sales. To make this fair we will remove the salary. Making the fixed cost return to $6992.52. Adding in the 33% profit means you need $2270.30 in sales or 190 guests a day. The question is do you want to stress getting that many people to eat with you every single day? After all the mathematical gymnastics we still have not priced a menu. That is easy. Want to run the 25% food cost that we just proved can pay a salary and has a low threshold guest count? Total all the ingredients and paper required for each menu item and multiply by at least four. 20% in your sights? Multiply by five. The last number in the equation is the average check. As a newbie you have no data to know what your guests are willing to spend. We can’t focus on what we don’t know, we must focus on what we do know. Designing a menu layout is another post, rest assured you can influence what is ordered and with suggestive selling hit your goal average check. Need help? Get on my schedule with a free no obligation one-hour consultation. Ask all the questions you need answered. NOTE: Yes, I know the difference in profit and prophet. We are in business. We want profit. I thought it was a cute play on words.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Bill MI have had a passion for helping people since an early age back in rural Kentucky. That passion grew into teaching and training managers and owners how to grow sales, increase profits, and retain guests. You’ll find a ton of information here about improving restaurant and food cart/trailer operations and profits. Got questions? Email me at [email protected] Archives

January 2023

|

RSS Feed

RSS Feed