|

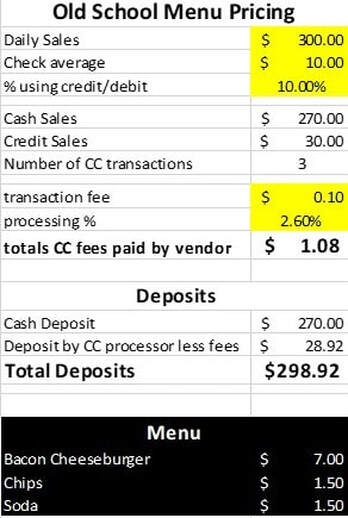

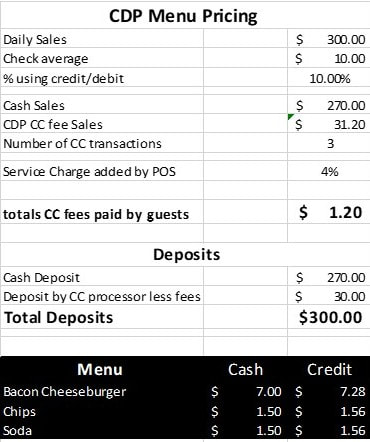

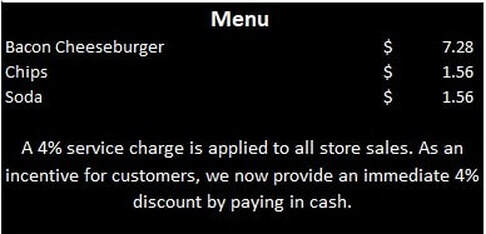

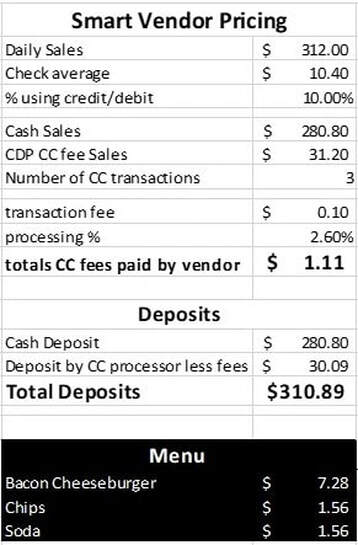

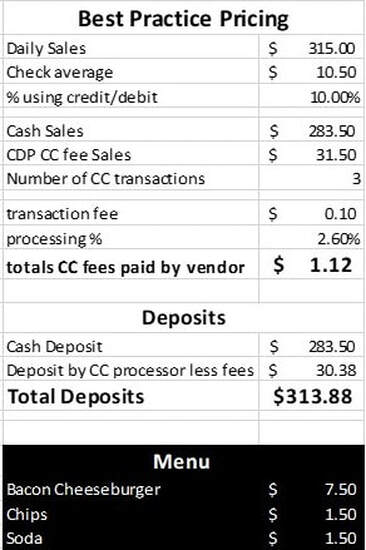

This is one of the three most often asked questions on Facebook groups with the least understanding of what is being asked. Most people really mean to ask, “what is the cheapest way to process credit cards?” A POS (point of sale) system is a computerized cash register. A POS often DOES NOT necessarily have integrated credit card processing. Credit card processing can be completely stand alone from the cash register. A POS can be an app like https://loyverse.com/us/pricing (FREE!) or Square (without using their card processing) or a physical machine like HarborTouch, Posi-Touch, NCR, Panasonic, etc., etc. All the average food vendor needs is basic inventory, net sales, taxes, discounts and sales mix capabilities in a POS. Processing credit cards can also be a part of a POS system or POS app. As can labor/payroll or distributor ordering add-ons or loyalty programs. The most important question – “What do I REALLY need at this stage of my business and how will it impact my profit.” Since over 80% of ALL payroll is direct deposit taking debit and credit is well past mandatory. A cash only vendor is or soon will be dying a slow death. The question is which credit card processor to use. I have already discussed credit cards at length here. This post will be showing the math and impact on your menu of the different payment strategies. Old School Approach  This old school price model shows a vendor using Square as credit card processor. Only 10% of his sales are in credit or debit processing. At the end of the day his bank account would have $298.92 in deposits since the Square would keep $1.08 in processing fees. Meaning the vendor is taking responsibility for processing fees. The guest credit card receipt will not have weasel words to explain an additional credit card fee. If two guests come up and order the same items, one pays cash and the other pays credit, they are charged the EXACT same price. No potential for service slowing complaints. This vendors menu is easy to read no confusing pricing and no easy to overlook disclaimers. Cash Discount Program (CDP)  A cash discount program is offered by several processing companies and utilizes rules allowed by all the credit card issuing institutions. At its basic form a vendor lists their menu pricing to include processing fees (usually 4% above cash price) and then offers a “discount” to guests opting to use cash. Then the credit card processor deposits money less the 4% processing fee. Effectively giving the vendor the same amount of money as if all his guests paid in cash. The menu becomes clumsy to read. Legally this program requires either TWO prices listed - one for cash and one for credit. Just like your local filling station. Or...  Your menu MUST include a disclaimer explaining the service charge and cash discount. Like this one. (Weasel words!) Any vendor with more than a day’s experience knows reading a menu is NOT a guest’s strong point. Let alone any language barrier. Now imagine those same two friends ordering the EXACT same food. One pays with cash and one pays with credit. Do you think for a second that the credit card purchaser will not complain? Even a half-hearted complaint will be heard by other guests and how you handle it will be remembered. No matter what the end result of the conversation may be, you have just increased your service times just to save a few pennies. Not exactly smart business. There will be guests that will happily pay the full amount credit listed on your menu. Think about that. If they happily pay the credit card amount, they are saying your food is worth the price! Then why would you discount someone choosing to pay in cash??? Does your food have less value for them? Smart Vendor Pricing If your guests don’t complain about a 4% service charge being already figured into your pricing, why not just drop the cash discount nonsense, raise your prices officially that extra 4% and you reap the profits rather than the scammer that convinced you use a CDP? In this example you can see the Average check increased $0.40 (4%) to reflect the menu price increase. Look at the deposits for the day. The smart vendor made an extra $10.89 with the exact same guest count. In other words, the vendor DID NOT give away hard earned money to have “free” credit card processing. The menu on the other hand contains pennies. If you are a tax included vendor this scares you. Let’s fix that. Best Practice Vending  A vendor that includes sales tax (or the state does not tax food sales) should price on the quarter. Making for less coin change needed. (Please don’t argue about change slows you down. It DOES NOT.) Be brave price on the quarter. The vendor now receives $13.88 MORE in deposits than if they fell for the “free” processing scams. Compared to the “old school” price model once they accounted for credit card processing in their menu prices, they made $14.96 MORE in deposits. The menu is easy to read with no service charge, cash discount nonsense disclaimer. Two friends ordering the exact same items pay the exact same total, no questions, comments, or complaints. Accounting for credit card processing in your menu prices is just like accounting for the bacon, cheese, meat, bun, condiments, wrapper, napkins, and a carryout bag for your Bacon Cheeseburger. It really is just that simple.

2 Comments

I see this question often on Facebook groups and usually don’t answer because I can’t really think of anything “I wish I had known”. My first vending operation was as a fundraiser operating off my restaurant’s food license. I provided food for shoppers attending a “Trash or Treasure” yard sale event held in a National Guard Armory. Our restaurant sold Coca Cola products and at the time Coke USA would loan small food trailers to restaurants as long as they bought post mix Coca Cola products to sell. They even provided cups! Coke dropped off the trailer Friday evening, gave brief training on the equipment and hook ups and told us they would be back Monday morning for pick up. Since the event ran only a few hours on Saturday that gave us way more time than needed for our event. We sold $1.00 hot dogs, $0.50 Coke and Chips. With every purchase we gave discounts and coupons for our restaurant as well as gave away logo t-shirts, coffee mugs and plastic cups. All profits went to the charity, our only goal was to promote our restaurant while raising some money for charity. At the end of the day we raised $425. Which does not sound like a lot but at $2.00 a combo that was a lot of guests we served. I remember running the P&L statement for the trailer and was surprised how much money we put on the bottom line to donate. I had the trailer pay for 2 employees, myself, ALL the Coke products plus all the food, coupon printing, flyers and give-a-ways. Still managed to write a check for the charity for $425. We got so much good press and community support from that one event the restaurant rode a wave of coupon redemption and positive comments for several weeks. What do I wish I had known? Nothing. What do I wish I had done differently? Started sooner. At that point I was 3 years into my career as a mediocre fast food manager. I had done a couple of good things and lots of ok things. Nothing special. I was very reserved, intelligent but painfully, almost cripplingly shy, full of self-doubt. I never thought I was good enough for anything or anyone. When I looked at my P&L for that event and realized I created 28% profit I was stunned. So, stunned I ran the numbers a second time, then a third time. A got the same result. Everything was paid in full and there was still $425 left over. I had done something WELL and could prove it! The very next day I took the trailer to our “central” park and set up near the playground. I operated a few hours before I had to go to the restaurant and run the closing shift. All by myself I pulled in more profit than I would make that night as a restaurant manager. Of course, the trailer went back Monday morning and it took me another year or so to get all the information, licenses and money necessary to operate under my own business rather than under the restaurant. But I did it. You see in 1981, there was no internet, food carts were a thing in big cities but virtually unheard of in rural America outside of the county fair. Social media was 25 years away, home computers with 20 megabits of memory were still years away from popularity. Every bit of information required time on a landline phone or physically going to the health department, city hall or the fire department. Mobile food vending was so unheard of that most officials I dealt with were clueless as to how to license one. Some permits officials thought I might need had nothing to do with food. On city suggested I needed a door to door solicitation permit! Nearly every code, regulation or restriction has sprang up over time to fill someone’s personal agenda. As rules were added I adapted. The mass of red tape, permits, licenses, restrictions that newbies whine about today were added slowly over time. Death by a thousand cuts for vendors of long tenure. Yet for nearly 40 years I survived it. A newbie should expect:

My advice? Start NOW. Research- read your state's food codes then move to county and city for food vendor restrictions. Note how much all the licenses and permits cost. See what is on the county and city commissioner’s agenda for the coming sessions. You don’t want surprises. Menu- based on your research and state restrictions develop your menu. Think in terms of what is missing from the food scene in your area or what can you measurable do better. More convenient location, higher quality food, better sanitation, faster service. Suppliers- find affordable high-quality food, paper and cleaning supplies as well as services you may need like credit card processing, a commissary, grease disposal etc. Work out the cost for each and shop around for better deals. Location- decide if you will operate at a set location (and where), travel a set route (with locations), vend at fairs, festivals & events, do private catering or a combination of all. Again, track costs involved with each. Once you do open ALWAYS be looking for your next site. Equipment- price used equipment that meets your menu needs. Understand you are purchasing EQUIPMENT not a business. Do not buy new until you have proved yourself in food vending. There are over 3000 used trucks and trailers for sale today. You don't want yours to be one next year. Once you have equipment on order then do all your permits and licenses. Some of your licenses will require floor plans of your equipment that is why you wait till this point for permits. Business Plan- write one. Do the market research, test your food on friends, family, co-workers and at church. Above all make your business plan prove to you the menu and business is viable BEFORE you spend any money. Marketing- Once you start your licensing process also set up and start your social media and overall marketing strategy. Facebook alone WON'T cut it. Mentor- Partner with an experienced food truck operator or food specific business coach to get your questions answered, provide guidance and support. If you want to be profitable from day one you will need the help of experienced folks. Even if you have food service experience at ANY level a vending business is very different. Short order cooking is good experience as is waitressing. Management training is helpful BUT all that experience WOEFULLY under prepares someone for owning and operating your own business. Notice purchasing equipment is NOT the first thing to do. Many people buy equipment then ask questions. By then it is too late. As a business owner you do not want an asset just sitting while you research how to use it. For me the work was always fun. I never once thought I was working hard. I was having fun and getting paid well to have it.  The debate rages on every single day on credit card processing fees. Newbies want information on who is the “best” processor, when what they really mean is “cheapest”. Someone with something to sell always answers “check my page” or “DM me and I’ll help”. Then my favorite answer always shows up: “charge them a fee that’s what I do.” The comments will also be flooded with “Square” and “Clover” followed with the naysayer’s complaints with each company. EVERY, and I do mean every, company has complaints against how it operates. Customer service, late/slow deposits, hidden fees, frozen accounts, middlemen, differing rates, equipment fees, on going charges, etc., etc. Square has them, Clover has them, as does all the other companies. Asking for my opinion or some else on a public forum like Facebook groups will only get a limited answer based on extremely limited experience. I have worked in this business since 1977 and taken credit cards since 1990. I started with Square in 2010 and with all that time in food service have only used a total of 5 different processors. Each with problems and benefits of their own. You should also understand there are two different types of processing companies out there. Square (PayPal Here, Intuit ToGo, etc.) are flat fee aggregators. Meaning the fee is exactly the same no matter which card is used and no merchant account is required. This makes the threshold to get started much simpler for the average food vendor. Clover (and a ton of other services) are merchant account processors. Meaning they require a merchant account (which some people will not qualify for) as well as possibly charge variable fees based on card type and brand. Comparing the two accounts types is unfair as they have completely different benefits and application requirements. To get a full understanding of each processor type and unbiased reviews go to https://www.merchantmaverick.com/review-category/mobile-credit-card-processing/. Pick the processor that meets your financial needs and has rates and fees your business can afford. Also understand what you need out of the hardware they offer. Do you need a simple POS or one with lots of inventory control, payroll functions, loyalty programs, etc. or do you just need to process credit cards? Here is what you need to know about accepting credit and debit cards. Keeping it simple for street vending.

As a business owner you have 4 choices:

Don’t take cards. I hope from the stats in numbers 1 & 2 above you understand taking cards is a necessary evil in street and event vending. In my 40 years of experience (through observation and actual time studies) credit card transactions are significantly faster than counting out change. Yes, there can be internet issues, connect issues, etc. that pop up from time to time. Cash has its own set of problems like breaking a Hundred dollar bill early in the day, using a counterfeit pen to verify bills, opening new rolls of coins, having to get more ones or fives, lots of cash on hand makes your business an easy target for robbery. Convinced to take cards yet? Since taking cards is a MUST DO for a food vendor let’s figure the best way to handle those pesky fees. Pass the fees along to your guests as a “convenience fee”. Seems smart right? Not really. Charging a fee comes across as petty and cheap from a guest perception point and is illegal in 10 states. Where the fees are legal, they have a 4% cap since the merchant CAN NOT PROFIT from charging a fee. “Convenience fees” become overly complicated when a debit card is presented rather than a credit card. https://www.thebalance.com/credit-card-surcharges-315423 Convenience fees are also frowned upon by the credit card issuers and each has a specific policies AGAINST these fees in most circumstances. https://www.creditcards.com/credit-card-news/credit-card-convenience-fees-cost-surcharges-1280.php Setting a minimum purchase complicates things as well. Debit cards present different rules than credit cards. It is also against the credit card issuer rules to set a minimum fee for debit cards. https://www.thebalance.com/debit-card-minimums-illegal-or-just-annoying-315267 OK, OK, no charging additional fees, what should a vendor consider? Offer a cash discount program (CDP). This type of program is allowed and actually spelled out in card issuer policies. https://s3.amazonaws.com/Harbortouch_Files/VBN_CashDiscount_101818.pdf A cash discount policy means a vendor must list TWO different prices for each product. Just like a gasoline station does that offers a cash discount. The pump will list one price marked “Credit” and one price marked “Cash”. Of course, the credit price is higher accounting for the processing fees. There are a number of companies that offer CDP processing, all of which use some promise of “free” (to you) processing. The bottom line for a legal CDP is to have a menu that clearly spells out both a cash and a credit price as well as other notifications that explain and/or alert your guests to the two-tier pricing system. The problem with this system is guest confusion and overly complicated price structures. Street or event vending is very much time bound. The faster you take and fill orders the more money you will make. But with CDP the order taking process is slowed down by lengthy explanations for a two-tier price system. As well as the complaints about having to pay more because the guest has no available cash. In food service every obstacle you place to a smooth order taking process gets magnified into a negative review, bad word of mouth or no repeat guests when another service or food related issue pops up. The simplest thing to is: Do the math when setting menu prices. Wow what a concept! Just like pricing your menu to account for the price of food and propane, just price your menu assuming EVERYONE is going to use a card. What?! Can it really be that easy? Yes, yes it can. Let’s look at a product that everyone freaked out about when Square raised fees to 10¢ + 2.6%. Soda. Coca Cola is available from Sam’s Club for 32.05¢ each. Most folks sell it for a dollar. When Square raised their price, people panicked, whining about the increase on a percentage basis for the least expensive product they sell, a soda. That makes selling a soda all by itself cost a vendor 44.65¢ when a card is used. I can’t tell how many posts whined about 13% charges, blah, blah, blah. Yet if Coke raised the price to 45¢ the vendor would either suck up the increase or raise their own price. When I price a menu, I assume everyone will use a card. When Square added that 10¢ transaction fee, I just added 25¢ to some of my higher food cost items to compensate. So that one-dollar soda became a $1.25 soda. Still cheaper than a convenience store and well cheaper than from a vending machine. The gross profit (which is sales less cost of goods) would look like this: Before: $1.00 - $0.3205 - $0.0275 = $0.6520 gross profit After: $1.25 - $0.3205 - $0.10 - $0.0260 = $0.8035 profit Look what happens when someone pays with cash. Cash: $1.25 - $0.3205 = $0.9295 Does it make any sense to use a cash discount program? Does it make any sense to add a surcharge (which is legally limited to 4% and you can’t show a profit from that charge)? Does it make financial sense to just refuse accepting cards? If you are stumped the answer is “NO”. I can hear someone saying, “I don’t deal with change it slows me down.” Food service is a nickel and dime business. Charging even dollars went out with the turn of the century. The only people charging on the even dollar are amateurs or mathematically challenged. Perhaps it is time to pull out the addition and subtraction flash cards from elementary school and learn how to deal with our nickel and dime business.  This week in all the usual nonsense, complaints and wrong advice was a real gem. A newbie asked about “handling taxes”. Thankfully most of the answers were at least legal and fairly helpful. Buried among them was this amazing answer. My first thought was this guy has read my books! “Many people back out the taxes from a flat rate price and then claim it is easier as a reason for doing so. Despite what anyone claims it is not advantageous to your crew or your business to do so. For the following reasons. #1 you must raise your prices every year at least 2% to account for inflation that has averaged 2% the past 15 years. If you do not bump your prices every year 2% by the 5th year you will be making 10% less money. By that time, you will be wondering why you can’t pay your Bill's or be closed. #2 you must account for food cost increases food cost increases don't care about round numbers. 3# change increases you tips both in cash and on the tip screen 4 you or your staff 4# it paces the orders coming in the window when there is a rush and ensures you get less jammed in the kitchen #5 it requires discipline and presents (sic) of mind to hand out change and count out you (sic) drawer people expect you to charge it and people expect to pay it. #6 depending on what state and town and metro you operate in sometimes there are 3 different taxes you must apply to you orders. That can rob you of money from your pocket and operation. There is no reason to take short cuts with taxes. Charge your 4 times food cost. Charge tax. Set it aside daily in a separate account. And manage your finances appropriately.” Let’s look at each point closely. #1 Inflation. Yes, on average inflation has been 2.11% since 2003. Going back to 1977 (when I started in food service) inflation has been 3.59% on average. (Source) BUT how does that translate in pricing that impact food vendors. Food in general since 1977 has risen slightly less at 3.32% per year. While in recent years food prices have risen faster than inflation at 2.28%, meaning your prices MUST increase otherwise your profits decrease. Point #1 validated. Point #2 Really is just a restatement of point #1, pointing out the limitations of using round numbers. Still a very true statement. Point #3 Change does tend to end up in tip jars. Using on the dollar pricing eliminates this option for your guests. As does avoiding $5.00- and $10.00-dollar price points. While a pain keeping ones on hand to make change it does increase overall tips. All coins and a $1.00 generally end up in the tip jar. Point #4. Pacing the kitchen orders. Absolutely counting back change will pace the speed of orders going into the kitchen. Transacting the cash or credit card is only a part of a well-trained cashier’s line pacing responsibilities. I suggest a written procedure that is trained from day one as well as practiced regardless of how busy or slow the meal period may be. Something along the lines of this: 3-5 seconds of greeting as personalized as possible for both the cashier and the guest. Immediately after the guest response suggestive sell your featured item. Complete the order and round out or up sell as necessary. Give the total and transact the cash or credit cards. Present the change or return the card and request a signature. Finally thank the guest and explain how/when/where the food will be presented to the guest. The overall process (depending on the complexity of your menu and the order) should be around 30 to 60 seconds for typical street food. Next you should have an average goal for the kitchen to produce the food. Again, depending on the complexity of your menu and your holding procedures the average ticket should be completed in 5 to 8 minutes for a cook to order operation. Yours could be much faster if you are able to pre-cook and hold, so all you do when an order is placed is assemble. What ever the average kitchen time is would be divided by the average order taking time. This number is your “weeds” threshold. For example, your order time is one minute and your kitchen time is 5 minutes the “weeds” threshold is 5. Meaning if a 6th ticket is on your screens or ticket rack there is a possible kitchen issue or the cashier is not pacing the line properly. A good cashier would recognize this situation as a problem waiting to happen and SLOW DOWN the next order taken allowing the kitchen time to complete an order or two. Once a guest has paid their perception of time is massively distorted by their anticipation of getting their hunger satisfied. Good food brings guest in, great service brings them back. Point #5 is not really clear but I believe the point is adding tax after the sale rather than including as a part of the menu price. Using on the dollar pricing made street food vending easier in the good old days for the mathematically challenged. In modern times with the advent of free POS app for cell phones there is no excuse not to add tax after the order is given. I personally include tax and price on the quarter just to save trips to the bank to get coins for change. Again, most coins end up as tips, so you are able to recycle coins anyway. Point #6 This is a great point sales tax can be assessed at the state, county and city levels. Then add in differing rules for application of tax like perhaps water is taxed at the state level but not the city level. All the more reason to have a POS to properly add in taxes. In my consulting with various food truck owners, nearly one fourth (25%) figured their sales taxes incorrectly often paying the revenue offices MORE than they owed. I especially like the tips this post author lists at the conclusion of his post. I have been saying 4 times cost (25% food cost) for a decade, yet the overwhelming majority of advice in Facebook groups recommends THREE times (33% food cost). The other tip concerning having a separate bank account is another one of my Best Practice recommendations. I suggest depositing the sales tax EVERY single day you vend using the total from your POS system.  Every couple of weeks I see a vendor or two express this thought. “we as Mobile Food Service Vendors need to unite. Somehow, someway we have got to make it clear to those who host and/or organize fairs, festivals and special events,....that Food Vendors make it successful. Without us, they're sucking buttermilk, and people won't come again. Therefore, them charging us to help them is counterproductive.” This my friends is why the vast majority of food vendors are part-time and will never be anything more than just that – part time. I agree food vendors need to unite and speak with one voice on many different issues we face. However, event fee structures is not a priority topic. Thinking food vendors "make it successful" is just plain arrogant. Do you really think a place like Disney World is successful because they sell food? You don't want to know the cost McDonald's paid to sell only French Fries in the Animal Kingdom when they had the kiosk there. No one went to the Animal Kingdom just because they sold McDonald's fries. Guess what? That kiosk is gone but the Animal Kingdom is still there. If McDonald's had no impact on attendance at Animal Kingdom why would a small time food vendor think they would have an impact on any positive event attendance? Food at events is and always will be a necessary evil for the attendees. Most folks (some actually plan this) would rather eat cheaply OUTSIDE the event so they can have more available money to enjoy more event attractions and spend less time in lines waiting for a food vendor to actually hustle. Events have different draws for different people. I am certain the music artist performing Friday night thinks they are the one making the event successful. But then again, the semi popular band from the 70's on Saturday night thinks they are the real reason. They all perform for free, right? Those crafty promoters must bathe in cash! How about the handmade craft people shouldn't they be allowed to just show up for free and sell their wares too? I mean after all, who really needs one more ceramic thingy to collect dust? The ride operators certainly they hate paying event fees. I know game operators with their profit margins would love free entry so they could laugh all the way to the bank. Event promoters do over schedule food vendors most often not because they want 20 trucks for 1000 people but because last year the lines were so long and slow moving they saw an opportunity to better serve their attendees by getting more trucks so the folks in those lines can get back to doing what they came to the event to do. Enjoy the concert, the games, the rides, buy a few crafts and have fun. They are going to eat today anyway. The concert, games, rides and memories make the day special. Not the vastly overpriced lemonade in a gaudy plastic "souvenir" cup. Every time you have a vendor brag about a 50-guest deep line that lasted all day that is an opportunity for the event promoter to have 4 more food vendors next year with lines only 10 people deep. The people that stand in a 50-person line may love the food but really, they are very hungry and tired so their judgment is already impaired. Think about speed of service. If the vendor is super-fast and moves one guest every thirty seconds the last dude in line still is waiting 25 minutes for, in many cases subpar massively overpriced food. That is 25 minutes they aren't spending money on crafts, playing games, riding rides or dancing to the band. If you want to talk about uniting so vendors can get better pricing on food, credit card processing, consistent laws on commissaries, cheaper food certification training, fighting local restrictions on daily vending, setting manufacturing standards for cart, trailer and truck design, setting realistic fire safety standards or getting rebates on supplies and equipment (like national restaurants accounts) I am all in. "Hello! Husband and I are wanting to open a food truck. Was wondering if it’s profitable. Any opinions? Thanks" Short answer is yes, they are profitable. Trouble is it takes a book or two (which I have written 😊) to explain how to be successful. There are several thousand used trailers and trucks for sale right now across the country. Too many folks jump in without research, plans and cash reserves to survive a full season. First thing you need to know is every state has different rules and regulations. Start with your area learn the laws you will have to follow. Next do market research on your planned service area. If after doing that you still want to pursue a food truck dream send me a message and I'll teach you the business so you'll be successful from day one. The above question and answer appeared on a Facebook group over the past weekend. I was hoping from my offer to help I could guide someone on the path to success. No strings attached. I posted my response minutes after the original poster ‘liked’ a different response. AND nothing. Another person did send me a message an hour or so later and I responded by letting them know I would help just ask any question. AND nothing. It has been two days and still no questions or acknowledgement from either. The first rule of business is “be present” meaning if you are at work then be 100% at work. Likewise, be 100% at home when at home. Don’t think of work while you are surrounded by family and don't think of family knee deep at work. If you need help and someone offers take advantage of it. When opportunity knocks - open the door otherwise opportunity walks away looking for the next door that will be opened. As always menu pricing is a hot topic. “Ok everyone, I have a question. I'm doing my homework on starting up my business and I'm trying to find out how much I should sell the dogs individually. It would cost me $1.38 for one dog. How much should I sell them for? I know it would be better for them to do a combo but what about each in case someone just wants a dog. TIA” Figuring a menu price is challenging. First question is does that include everything you will put on the dog as well as the paper items like napkins and some type of wrapper or box? Next question is do you plan on including sales tax in your menu price? Finally, will you be one of the old timers and only price on the even dollar or will you price using coins? Assuming your cost price of $1.38 includes EVERYTHING both food and paper wise your base menu price will need to be at least $4.18 (33% food cost) and up to $5.52 (25% food cost). If you plan on including tax and pricing on the dollar, I hope you can see the problem selling at $4.00. Not knowing your exact tax rate I'll figure a 5% rate which puts the food cost at a very scary 36.22% if you chose the coin-phobic $4.00 price. Don't forget credit card processing fees. Those eat into profits as well. The real question is: will your guests see the value in your product and be willing to pay a $5.00 or more price for a single hot dog? Local economics plays a large role in determining your menu price as well as any competition you may have. Folks that recommend a certain price can only speak to their own economy and guests, what works in one place may spell disaster in another. One curious person asked me what I meant by “coin-phobic”. I responded: Many vendors subscribe to the premise that pricing using coins (quarters, nickels, dimes, etc.) slows down overall service and makes adding up charges easier. Hence, they price only on the even dollar. This forces them to either eat supply increases until they feel a full dollar jump in menu price is justified or whine and complain they are not making any money until they just go out of business. Pricing on the quarter is simple mathematically, keeps your menu price to product's perceived value in line and makes it less noticeable when you have to raise prices. Going from a $3.00 to a $4.00 hot dog is a jump guest notice and will complain about. A smaller jump from $3.00 to $3.25 is less noticeable and still reads mentally as "three dollars". I used the made-up word "coin-phobic" to illustrate the point many vendors are "afraid" of pricing using coins for many unfounded reasons. Mentally adding up 'on the quarter' pricing is no more difficult than adding up 'on the dollar' pricing for those folks still not using a POS system. (that one still amazes me) It is all about training yourself. Just like one day the baby doesn't know how to walk and then it does. The even dollar pricing is recommended by a hot dog “guru”. The advice is followed blindly by the inexperienced. The bottom line is this: you started a business to make money, perhaps learning how to add and count change should be a priority BEFORE opening for business. |

Bill MI have had a passion for helping people since an early age back in rural Kentucky. That passion grew into teaching and training managers and owners how to grow sales, increase profits, and retain guests. You’ll find a ton of information here about improving restaurant and food cart/trailer operations and profits. Got questions? Email me at Bill_Moore@live.com Archives

January 2023

|

RSS Feed

RSS Feed